Bitcoin’s only some weird digital money, interesting to cypherpunks only? With nearly all financial institutions investigating or investing in Bitcoin-related technologies I guess the answer is obvious. But does Bitcoin have any value to you, if you’re not into the banking? Certainly: a lot of innovative products work on top of Bitcoin or use the blockchain in another way. In this article I’ll list some recognizable problems, from Bicycle-renting to digitally signing documents to selling the electricity your windmill has generated to your neighbor, and solutions on the blockchain.

Stock-exchange

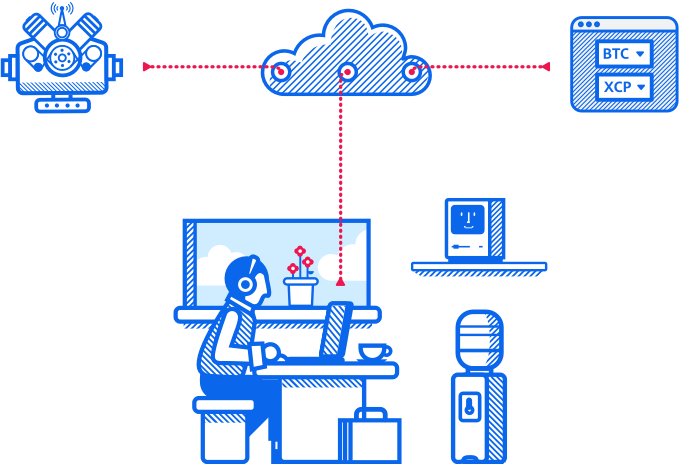

Do you want to create your own coin? Issue shares or other kind of securities for your company, association, trust, foundation, e.g.? Or do you want to buy something like a 3d-printer with multiple people, sharing the costs? Then you’ll at least need a registry of who ones what share for what valuation. Organizations trust their accountant or treasurer to maintain something like an Excel-document with the overview of shares, but that’s pretty expensive and/or cumbersome. Also you’ll have to trust that person in maintaining your registry properly.

Can we do better? Try

Counterparty! Counterparty works on top of the Bitcoin-network, and extends its functionality.

You can issue any security, bond, coin, coupon using Counterparty to replace your shared Excel. So you’ll have all the power of a stock-exchange, but with very low costs.

Rent-a-thing

Let me start with an Dutch phenomenon to explain: in the Netherlands you can bikes at train stations via OV-fiets. Using an electronic card you can unlock a box to rent a single bike. When you’re done cycling you can return the bike again. Large stations usually have a few people repairing the bicycles which will swipe the card for you, but during nights of smaller stations run completely autonomous. At the end of each month you’ll be billed for amount of hours you’ve rent a bike.g into much details: if you’d compare Bitcoin with a giant shared Excel, Ethereum would be giant shared Visual basic program, allowing functionality that goes far beyond assets and transactions.

The essence of Slock.it is their electronic locks, which someone can operate via a mobile phone.

The locks can be attached to anything you’d want to rent, or which contains the thing you’d want to rent, closet, barn, garage, room. Like companies listed here, Slock.it is just starting. They expect to be able to start selling their product in 2016.

Proof on the internet

If you want to legally proof the existence of any document at a certain moment, like a contract or an story or just an email with a simple notice, numerous services exist to digitally sign your document, like Silanis’ E-Signature, Adobo’s eSign services or lesser known Dutch companies like RPost or Xolphin’s Digitale Handtekeningen.

Their main disadvantage: you’ll have to trust a company to properly create and maintain your digital signature. Bitcoin was originally created to transfer and store currency over the internet without relying on a central bank. Proof of Existence allows you to directly digitally sign a document on Bitcoin’s network, like this person who registered his daughters birth on the blockchain without needing a notary or a civil register. The actual document can be stored anywhere, like your own homepage or on a disk stored in a save. On the Bitcoin only a hash digital signature is stored, proving to anyone the document isn’t altered and existed since a certain moment. There’s no third party to trust. As long as enough people still use (and value) Bitcoin, which could as well be only you and the persons for which your document has value, your signature exists.

Register of things

I assume you know the value of a cadaster like the Dutch Kadaster, a registry of companies like the Dutch KvK or British Chambers of Commerce or a registry of cars like RDW. Their primary function is proving that a certain document existed at a certain moment, which in turn proofs ownership of something. Although reliable in at least the Netherlands, these institutions are quite costly, even for just accessing their data. Can we use the blockchain for that, or even Bitcoin? As shown above, you can use Bitcoin to proof existence of documents, which might as well be description of a parcel of land, a founding document or vehicle registration.

Unfortunately, Bitcoin is not suited for signing dozens, let alone thousands of documents per second. Enter Factom. Factom stores a checksum of the document on a side-blockchain, that’s synced with Bitcoin. This allows Factom to be easier to use and much faster.

Factom offers an API as well as professional services. They’re raising money while I’m writing this article. I haven’t invested money yet, but I’ve noticed reached their target and I’ve no doubt the on million Euro money is better spent than over three hundred million Euro Greece has spent to set up their cadastre.

Peer to peer electricity

More and more homes have solar panels on their rooftops so they can use the sun to generate extra electricity.

Windmills not only have to be placed at the country side or at sea but may appear on rooftops in your neighbourhood too.

If you can use that energy directly that’ll save you quite some money on your electricity bill, but what if you can’t use that energy? In many countries you’ll get a minor fee from your electricity utility company for feeding electricity back into the grid, but that fee is rapidly declining. What if you could just sell or buy your energy to someone else directly? Or could you combine the solar panels of the whole neighborhood of like-minded people into one giant pv-powerplant?

Vandebron was the first Dutch company to give you the possibility to buy directly from producers, but already becomes old-fashioned. While regulators are catching up, companies like Mosaic, Piclo are one of the many upcoming companies that allow you to sell or buy energy directly from other producing consumers ”’prosumers”’.

In all those cases there’s still a central party managing the grid, doing the billing and making sure production and consumption is in balance. Do we still need such a central party? Electricity is a whole lot more complicated than getting a ride from a taxi or renting an house. Supply and demand have to be in perfect balance, instability can have devastating effect.

Loving a challenge, innovative companies are already working on a grid that’s self-managed, without the need for an regulatory organization and grid-operator. A grid on the blockchain.

Consensys’ is creating TransActiveGrid and Farmshare, EtherMetrics is in development. You can be certain traditional big players in the energy-sector are investigating the self-managed grid too.

In countries like the Netherlands, were gas and coal power is abundant these kind of self-managing grids seem rather superfluous. In other countries, including developed countries like Belgium and parts of the US, the grid is already up to its max. Gigantic capital investments will be needed to keep the grid stable if being used in the traditional way, regardless of we want to reduce carbon emissions or dependence on authoritarian states. An advanced, self-regulating and -managing grid can be great cost savers as well enabler for transformation of the energy-market.

Big changes are to be expected!